Interchange Rates

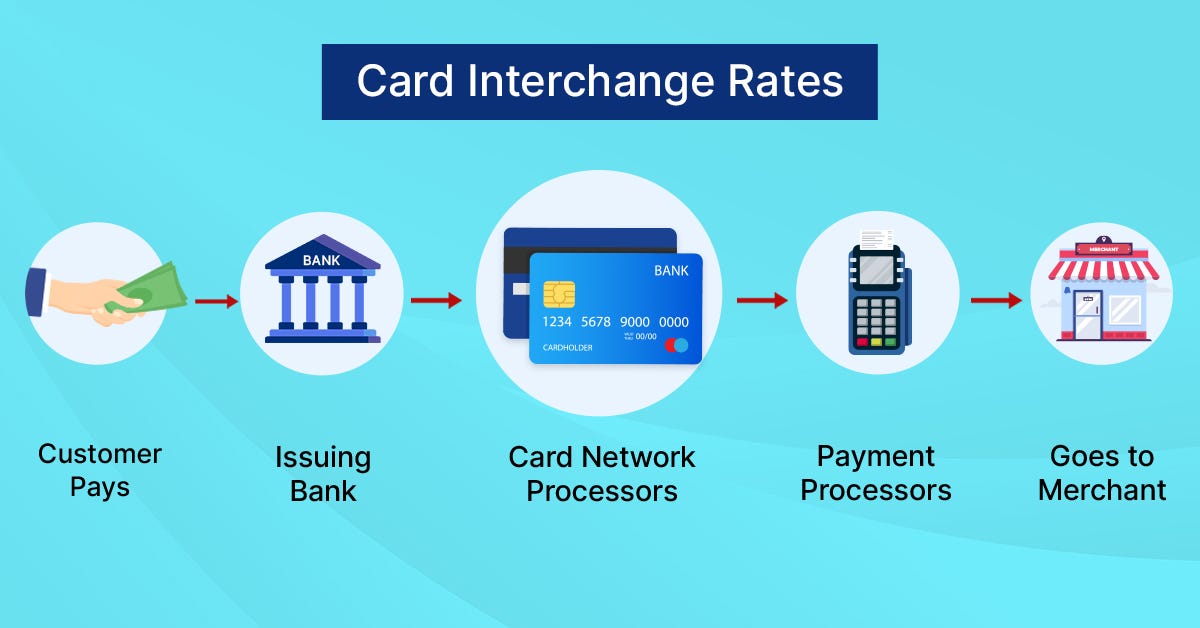

Interchange rates are the fees that card-issuing banks charge merchants for accepting card payments. These fees compensate the banks for the risks and costs associated with processing card transactions. The interchange rate is typically a combination of a percentage of the transaction amount and a fixed fee per transaction.

Key Factors Influencing Interchange Rates

Interchange rates are not static; they vary based on several factors:

- Card Type:

- Credit Cards: Generally have higher interchange rates than debit cards.

- Debit Cards: Often have lower rates, especially for card-present transactions.

- Rewards Cards: These cards, offering benefits like cash back or travel points, tend to have higher interchange rates.

- Business Cards: Typically have higher rates due to the perceived higher risk and the additional benefits provided to cardholders.

- Transaction Method:

- Card-Present (CP): Transactions where the card is physically present, such as in-store purchases, usually have lower rates due to reduced fraud risk.

- Card-Not-Present (CNP): Includes online, over-the-phone, or mail-order transactions. These generally incur higher fees due to increased fraud risk.

- Keyed-In Transactions: Manually entered card details, often seen as higher risk and thus attract higher fees.

- Merchant Category Code (MCC):

- The MCC is a four-digit code that represents the type of business. Each industry has different associated risks, which influence the interchange rate. For instance, retail stores might have lower rates compared to high-risk industries like travel or gambling.

- Transaction Size:

- Larger transactions might have a different fee structure. For example, microtransactions (small amounts) might attract a higher percentage fee but a lower fixed fee, whereas larger transactions might have a lower percentage fee.

- Processing Volume:

- Merchants processing higher volumes may negotiate better rates. Higher volume indicates a stable business, reducing the perceived risk for processors.

Breakdown of Interchange Rate Components

Interchange rates are usually composed of two parts:

- Percentage Fee: A small percentage of the total transaction amount.

- Fixed Fee: A fixed amount added to the percentage fee per transaction.

Importance for Merchants

Understanding interchange rates is crucial for merchants because these fees directly impact their profit margins. For a company that processes payments, either for product sales, subscription services, or donations, managing these costs is vital. High interchange fees can significantly reduce profit margins, especially for small businesses.

Strategies to Manage Interchange Rates

- Choose the Right Payment Processor:

- Payment processors can offer different pricing models. Some offer interchange-plus pricing (a transparent model where you pay the interchange rate plus a fixed markup), while others offer bundled pricing (a fixed rate that includes interchange and markup). Evaluate which model works best for your business.

- Optimize Checkout Process:

- Encouraging card-present transactions, where feasible, can lower rates. For online transactions, using secure and recognized payment gateways can help reduce the risk and potentially lower fees.

- Monitor and Analyze Fees:

- Regularly reviewing your transaction fees can help identify trends and areas where you might reduce costs. Detailed analytics can reveal which card types or transaction methods are costing you the most.

- Negotiate with Your Processor:

- If your business has grown and you’re processing higher volumes, it’s worth negotiating with your payment processor for better rates. Highlight your transaction volume and low chargeback rates as leverage.

- Encourage Debit Card Payments:

- Since debit cards typically have lower interchange rates, offering incentives for customers to use debit cards can reduce overall fees.

Understanding Basis Points and Their Significance in Interchange Rates

When discussing financial metrics and interchange rates, terms like “basis points” often come up. Understanding these terms is essential for grasping the nuances of payment processing fees and effectively managing the costs associated with them.

What is a Basis Point?

A basis point (often abbreviated as “bps”) is a unit of measure used in finance to describe the percentage change in the value or rate of a financial instrument. One basis point is equal to 1/100th of a percentage point, or 0.01%. Therefore, 100 basis points equal 1%.

Examples:

- 1 basis point = 0.01%

- 10 basis points = 0.10%

- 100 basis points = 1.00%

Importance of Basis Points

Basis points are commonly used in contexts where even small changes in rates or percentages can have significant implications. They provide a precise and clear way to describe changes in financial metrics without ambiguity.

Interchange Rates and Basis Points

Interchange rates, the fees charged by card networks for processing transactions, are often discussed in terms of basis points. Payment processors might quote their fees as a certain number of basis points above the interchange rate. This helps in precisely communicating the additional cost over the base interchange rate.

What Does “Thirty Basis Points Above the Interchange Rate” Mean?

When a payment processor says they charge “thirty basis points above the interchange rate,” it means they are adding an extra 0.30% on top of the interchange rate set by the card networks.

Example Calculation:

- Base Interchange Rate: Assume the interchange rate for a Visa credit card transaction is 1.80%.

- Additional Basis Points: The processor charges 30 basis points above this rate.

To calculate the total fee:

- Convert the basis points to a percentage: 30 basis points = 0.30%

- Add this to the base interchange rate: 1.80% + 0.30% = 2.10%

So, the total rate the merchant pays is 2.10%.

Why Use Basis Points?

Using basis points simplifies the communication of small changes in rates, which is particularly useful in the financial industry where precision is crucial. It avoids confusion that can arise from using decimal percentages.

Impact on Merchants

Understanding basis points and how they are applied to interchange rates helps merchants in several ways:

- Cost Clarity: Merchants can clearly see the markup added by their payment processor over the base interchange rate.

- Negotiation: Being familiar with basis points allows merchants to negotiate better rates with processors, potentially saving on transaction fees.

- Budgeting and Forecasting: Accurate knowledge of the fees helps in precise financial planning and forecasting, ensuring better budget management.

Practical Example for Your WordPress Blog

If your WordPress blog processes payments and your processor offers a rate of 30 basis points above the interchange rate, you need to understand the total cost:

- Interchange Rate: 1.80% (example for a Visa credit card transaction)

- Processor Markup: 0.30% (30 basis points)

Total Fee: 1.80% (interchange) + 0.30% (markup) = 2.10%

For a transaction of $100:

- Fee in Dollars: $100 * 2.10% = $2.10

This means for every $100 processed, $2.10 goes towards interchange and processing fees.

Conclusion

Understanding interchange rates and basis points is essential for effectively managing payment processing costs for your business. Interchange rates, set by card networks, vary based on factors like card type and transaction method, and directly impact your bottom line. Basis points, which represent 0.01% each, provide a precise way to describe changes in these rates. When payment processors add basis points to interchange rates, it’s crucial to understand this markup to accurately assess total fees. Mastering these concepts allows you to optimize payment strategies, negotiate better rates, and ensure efficient financial planning.